North Dakota offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

North Dakota State Capitol

600 E Boulevard Ave,

Bismarck, ND 58505

(701) 328-2471

Hours: M-F 8:00am-5:00pm

Xcel Energy

414 Nicollet Mall

Minneapolis, MN 55401

Phone: (800) 895-4999

Email: [email protected]

Hours: M-F 7:00am-7:00pm, Sat 9:00am-5:00pm

Energy Division

North Dakota Department of Commerce

Office of Renewable Energy & Energy Efficiency

P.O. Box 2057

1600 East Century Avenue, Suite 2

Bismarck, ND 58502-2057

Phone: (701) 328-5300

Email: [email protected]

Hours: M-F 8:00am-5:00pm

Bismarck Weather Bureau

2301 University Drive

Building 27

Bismarck, ND 58504

Phone: (701) 250-4224

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | 100% for 5 years | Property tax on the increase in home value from renewable energy upgrade |

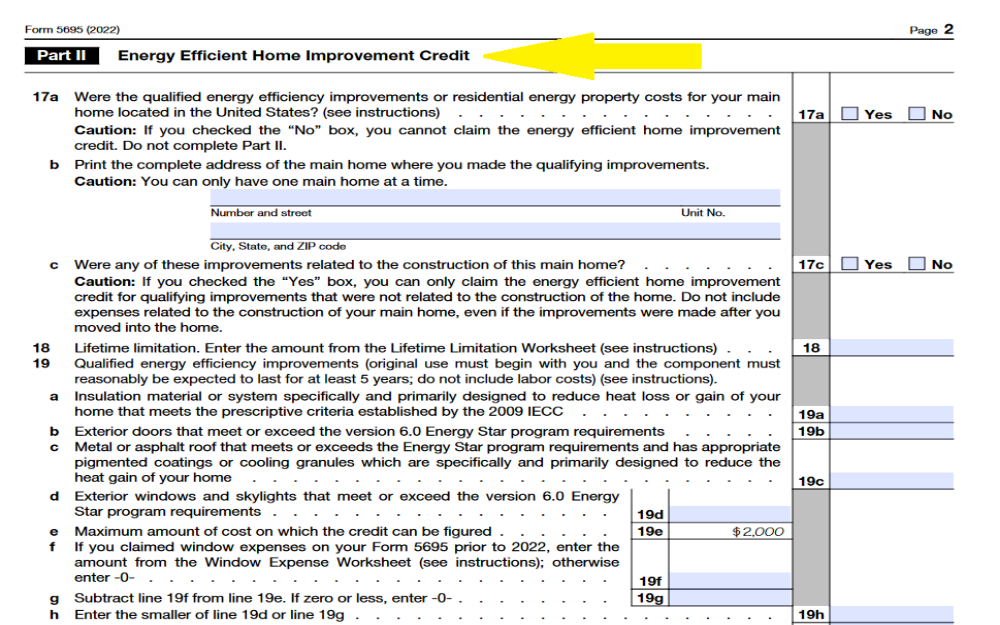

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

North Dakota Clean Energy

Renewable Energy Program

Clean Sustainable Energy Authority

Laws & Incentives

Inflation Reduction Act

Power Outage Map

North Dakota Department of Environmental Quality

4201 Normandy Street

Bismarck, ND 58503-1324

P: 701-328-5150

F: 701-328-5200

E: [email protected]

Chemistry Lab

2635 East Main

P.O. Box 5520

Bismarck, ND 58501

H: Monday – Friday: 8:00 AM to 4:30 PM

P: 701-328-6140

F: 701-328-6280

Environmental Training Center

2639 East Main

Bismarck, ND 58501

H: Monday – Friday: 8:00 AM to 4:30 PM

P: 701-328-6628

Fargo Field Office

1120 28th Ave N, Suite B

Fargo, ND 58102

H: Monday – Friday: 8:00 AM to 4:30 PM

P:Christine Roob, 701-298-4638

P:Jane Kangas, 701-298-4637

Gwinner – Big Dipper Enterprises Field Office

7972 129th Ave. SE

P.O. Box 218

Gwinner, ND 58040

H: Monday – Friday: 8:00 AM to 4:30 PM

P:701-328-5166

F:701-328-5200

Sawyer Disposal Services Field Office

12400 247th Ave. SE

P.O. Box 168

Sawyer, ND 58781

H: Monday – Friday: 7:30 AM to 4:00 PM

P:Daniel Gertis, 701-857-8638

F: 701-328-5200

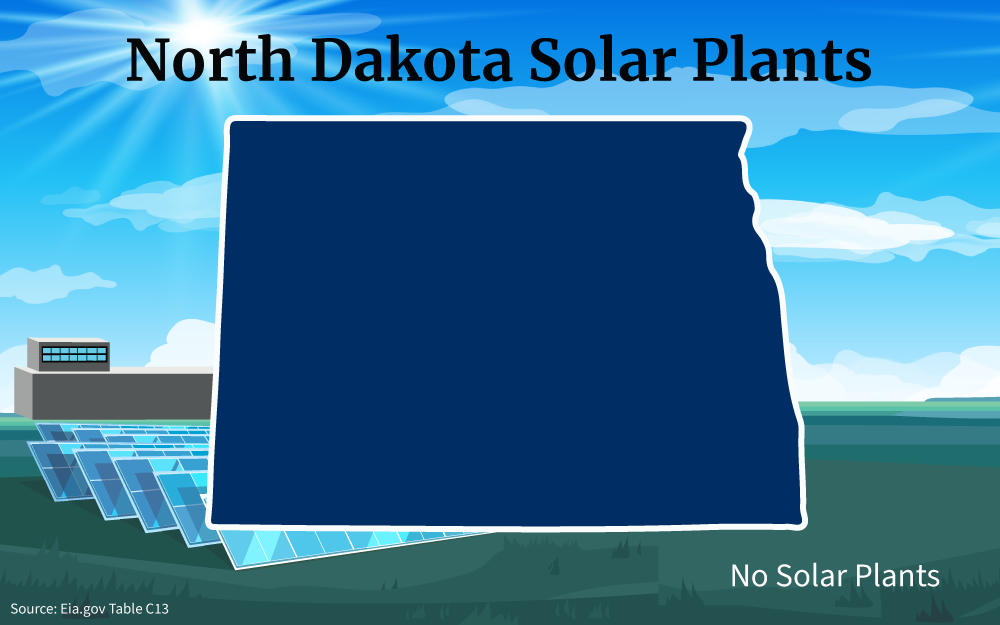

North Dakota Solar Energy Overview

Solar panels produce clean energy, yet despite this awareness, North Dakota’s legislators have yet to introduce substantial North Dakota solar incentives to make the transition to solar more appealing for homeowners.

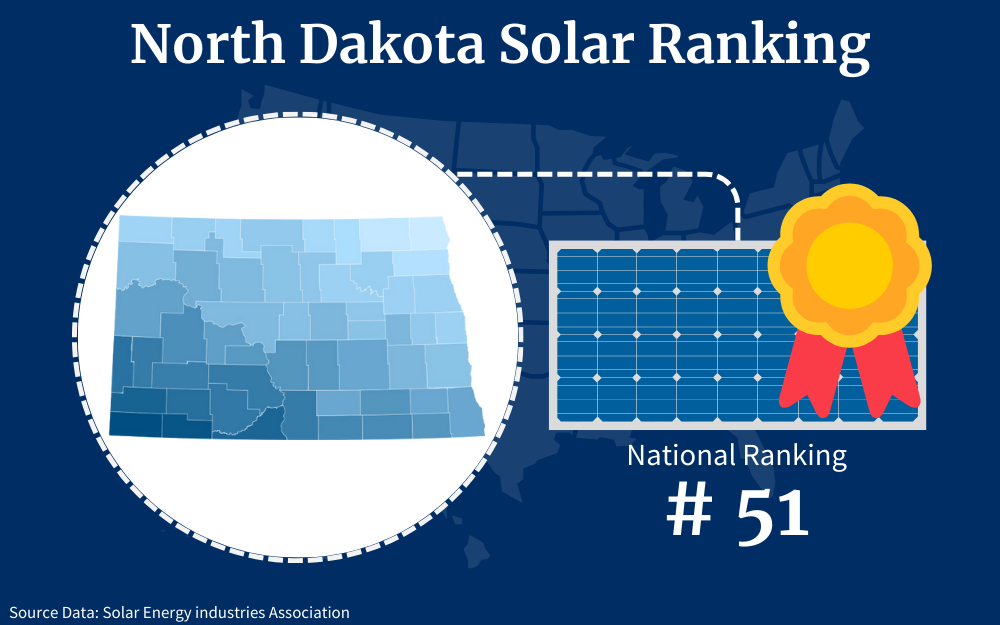

Home solar here pays for itself 5 years sooner than it did only a few years ago due to the worldwide price reduction in the cost of solar equipment and installation, yet currently the state ranks 51 in the nation (including Washington DC) for solar implementation.

However, that doesn’t mean that there aren’t ways to save in the state, thanks to local renewable energy efforts and federal credits, North Dakota solar incentives can be used to reduce the cost of installing a home solar energy system.

This guide outlines all the ways residents in ND can take advantage of government solar programs and rebates to save money.

What Solar Credits Are Available in North Dakota?

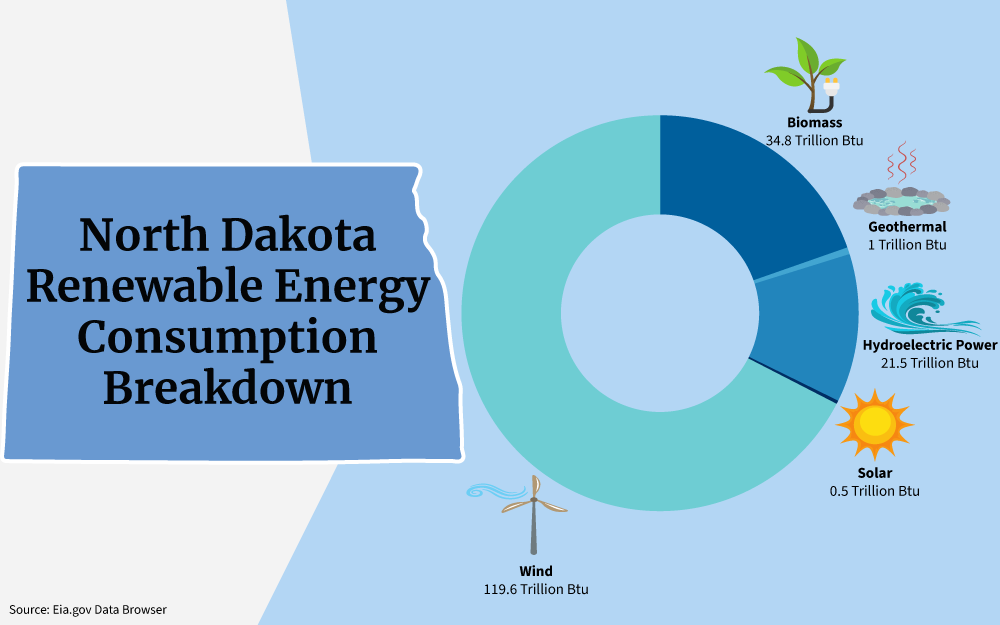

Coal and wind are the two most frequent energy sources in North Dakota today, with solar being somewhat less popular. One of the reasons for this is the price of electricity in the state which is approximately 26% cheaper on average than in some parts of the country.

For some residents, this makes installing a home solar energy system not very cost-effective.

There is still a relatively small solar capacity which is expected to grow by 508 MW over the next five years. And in an effort to showcase the benefits of solar energy installations, more incentives are being made available.

- First and foremost, there is the ITC that can reduce the average cost of a $24,000 solar system in North Dakota by 30%.

- The property tax exemption scheme protects homeowners from being taxed on the increased value gained from installing a PV system.

Let’s have a look at them in more detail.

EERE Programs Explained: Residential Solar Tax Credits (How Can I Apply for Solar Tax Credits in North Dakota?)

There is less variety of installers and financial incentives for those inhabitants who want to put solar panels on their homes in North Dakota compared to other states.

Currently, there are only 8 companies that have installed enough solar panels to generate sufficient energy to power just 149 homes. But there is still hope in the state to increase that number in the form of the ITC.

The Office of Energy Efficiency and Renewable Energy (EERE) is dedicated to promoting clean renewable energy throughout the United States in conjunction with the Inflation Reduction Act.1 The signing of the IRA in 2022 by the federal government, extended the ITC which affirmed the government’s commitment to make renewable energies more affordable on a national level.

The Federal Solar Tax Credit (ITC)

Any U.S. resident who has installed a solar panel system and lives in a single-family house, condo, or cooperative may claim the federal solar tax credit in the year of installation. In order to qualify for federal solar tax credits, applicants must meet the following requirements, as outlined by the Office of Energy Efficiency & Renewable Energy (EERE).

- If you are leasing your solar panels whether you are the owner of the property or not, however, you will not be eligible for the credit.

- The 30% federal solar tax credit is available just once per taxpayer on their primary residence and cannot be claimed on other properties that you may own.

- The applicant has to be a taxpayer within the United States.

- The system has to be new and not a repurposed one, nor can the credit be used to retrofit an old system.

In operation since 2005, the program is now referred to as the Residential Clean Energy Credit and is the preeminent incentive that is available in North Dakota.

On an official quote of $24,000, $7,200 can be saved. Larger properties or commercial facilities that have solar costs of $50,000 to $100,000 have the possibility of saving $15,000 to $30,000.

There used to be a cap of $2,000 on the amount that could be claimed, but that was removed by the Obama administration in 2008. Since then there has been no limit placed on the amount that can be levied against your tax liabilities.

And that’s how it works.

The whole photovoltaic system must be paid for in full, either out of pocket or via a loan agreement, and fully installed before you can apply for the ITC tax credit.

Here are the steps in working on IRS form 5695:

Step 1. Gather Your Information: Collect all relevant documents, receipts, and information related to the energy-efficient improvements made to your home.

Step 2. Download IRS Form 5695: Visit the official IRS website to download the most current version of Form 5695.

Step 3. Complete IRS Form 5695: Fill out the federal IRS Form 5695 following the instructions provided in the form itself. This includes listing the energy-efficient improvements you made, their costs, and any associated tax credits.

Step 4. File Your Federal Tax Return: Attach the completed Form 5695 to your federal tax return (e.g., Form 1040) and submit it to the IRS.

Step 5. Keep Records: Retain copies of all documents and receipts for your records in case of an audit.

When filing your federal income tax return, IRS Form 5695 has to be completed with details of the entire project, such as:2

- Type of system installed, potency, list of components.

- Registered address.

- Name and address of qualified installer.

- The total cost of the system.

- Amount of the 30% tax credit to be claimed.

- Your taxes for that year.

Once submitted, the savings of $7,200 from your solar investment of $24,000 will result in a lowered tax bill. If your tax bill is only $1,200, don’t be dismayed that the remaining $6,000 will be lost to you, but also don’t get excited that you’re going to get a nice check in the post any time soon.

For that first year, your income tax will be zero, and the remaining credit of $6,000 will be available to be claimed in the following tax year, with the process and the filing of Form 5695 to be repeated.

When Do Federal Credits Expire?

Well, this process will continue either until the credits are fully used up, or 5 years have elapsed. In the final year, if there are any unclaimed credits, they will no longer be able to be levied against your taxes due and will have expired.

The ITC is not solely limited to home solar energy systems that have been installed in properties with 4 walls and a roof. It is available to owners of mobile homes, condos, houseboats, as well as businesses.

It has proven to be one of the most important solar stimulus programs in the industry, yet it was still earmarked to come to an end in 2022.

Fortunately, it was granted a lifeline by President Joe Biden under the IRA with a new date of 2035.

Before that date, the ITC will be reduced to 26% in 2033 and then to 22% in 2034, lasting until the end of the year when do federal credits expire.. Unless it is extended again due to popular demand.

North Dakota Solar Property Tax Exemption

A valuable program that North Dakota has made available for homeowners to install solar systems without being penalized when paying their property taxes is this specific initiative.3 It exempts the property owner from paying the 4.5% property tax on the added valuation of the property due to installing a home improvement item such as solar panels that create green electricity.

House prices in North Dakota average at $252,788 and a new solar array will increase that amount by about 4%. That would increase the value of the property by $10,111.

With a property tax exemption of 4.5%, a figure of $455 will be saved every year. Multiply that by the lifetime of the system, 25 years, and you will benefit from saving taxes of around $11,375.

Similar to the ITC, the amount will be subject to the regulations under the EERE and have a sunset date of 5 years after the application has been accepted, and when it can be levied against your income taxes. Your installer or your tax assessor will help you to fill out the necessary forms.

Additional Local Renewable Energy Rebates and Solar Programs

In addition to the state-wide benefits, local utility providers offer significant rebates and incentives for reducing energy use and installing renewable energy systems.

These rebates are generally backed by federal finds, but can be used to get money back when you upgrade older appliances, heat pumps, water heaters and HVAC systems to energy efficient models.

Among the utility providers who offer the programs include:

- Cavalier Municipal Utilities

- Ottertail Power Company

- Hillsboro Municipal Utilities

- Lakota Municipal Utilities

- Northwood Municipal Utilities

- Valley City Public Works

Additional federal funds are being issued to states this year, so check you local company if you don’t see it listed above.

How Much Do Solar Panels Cost in North Dakota?

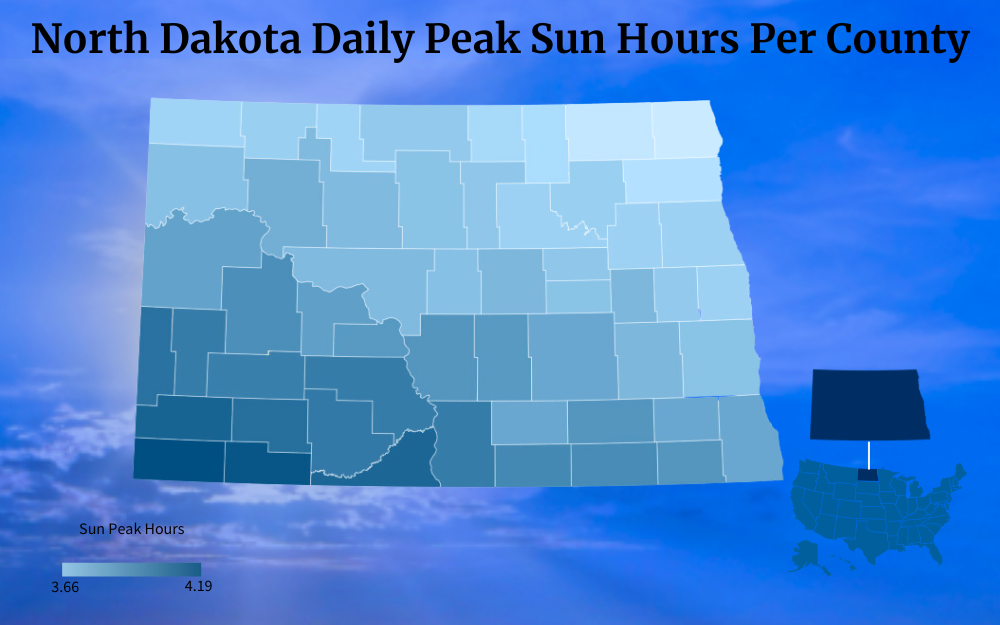

A typical household will pay about $24,000 and have solar panels with a power rating of 400 kWh used in their installations. Rooftops are the normal locations for these types of projects to capture the maximum amount of peak daily sunlight possible, which in North Dakota happens to be 4.5 hours a day on average.

A solar cost calculator can assist in determining how much all of this is going to cost, how much solar power is being generated,4 and how many panels you’re going to have to install if your property is not within the range of average.

If you prefer to do a quick manual calculation you can do so by using the peak hours, monthly electricity usage, and the wattage of the solar panels.

- Daily peak sun of 4.5 x 30 days = 135 (solar hours in a month)

- The monthly elec reading 1,041 / 135 = 7.7 kWh

- To convert to watts 7.7 kWh X 1,000 = 7,700 watts.

- 7,700 / 400 kWh (solar panel) = 19 solar panels

The average number of solar panels for a household nationally is between 17-21, but that can vary depending on whether you live on a houseboat in a state with 6 peak sun hours a day or a 10-bedroom house that consumes 5,000 kWh a month but only gets 3.5 daily peak sun hours. To get more exact readings, your solar contractor will consult your utility bill, survey your rooftop, and advise you of potential areas where you may save some money on installation costs and equipment.

Solar rooftop installations include more than just the solar cells themselves, and different roofs sometimes require different pieces of equipment if the pitch of the roof is not at the right angle or is overshadowed by a nearby building or trees.

These are the primary parts required:

- Photovoltaic cells

- An aluminum frame to hold the arrays together

- The solar array’s front and back protective covers

- An inverter with a junction box

- A monitor

- A battery bank with a charge controller

- A solar panel racking system to secure the solar panels in place

The placement of the aluminum or steel roof anchor bolts and the number needed will depend on the quality of your roof. It’s important also to appreciate that a 400-watt solar panel can weigh around 45 pounds (20 kg), so your roof has to be structurally stable enough to support 20 of them – for 25 years.

A good installation technician will be able to evaluate the integrity of your roof, install the PV system so it functions optimally, and leave you feeling confident that your solar investment was a smart choice.

How To Use a Residential Solar Panel Calculator

The amount you save depends on a number of factors, including the size of your PV system, the amount of energy you consume, the energy costs in your location, and the size of your solar panels. Taking advantage of an online PV watts calculator, gives you the flexibility to play around with “what ifs”, to get closer to the price you want to pay.

In the calculator, you can adjust the potency of the panels to be aware of the various solar panel production outputs between a 350-watt panel and a 500 watt, calculate how much you can save by making some small changes to reduce the amount of electricity consumed, and even see what the cost would be without a battery bank.

In just this area alone, a huge saving can be made. You may still need 19 solar panels, but by subtracting an expensive row of batteries for storage, some homeowners have saved $4,000-$5,000 straight away.

Have a look at the solar savings calculator below, enter your details, play around with the figures, and play the “what if” game. You’ll be surprised where savings can be made.

To calculate how much can be saved over the lifetime of your system, which is between 25 to 30 years, use this formula:

- 1,041 (kWh per month) X 11.70 /kWh c to get the monthly bill of $ 121.78

- 121.78 X 12 months = $1,461.36 savings per year

- $1,461.36 X 25-year lifespan = $36,534

The payback period has to be factored into this equation, however, to get a more realistic figure. In North Dakota, it takes about 13 years before the money saved through your electricity bills is equal to the money you have initially outlayed to purchase and install the system.

With this information, it is easier to calculate when your investment will start paying for itself in the form of clean green power.5 Subtract the 13-year payback period from the solar panel’s 25-year lifespan and then multiply that by the yearly accumulation of past bills.

$1,461.36 x 12 = $17,536.32 of total savings

Even in North Dakota, solar panels are worth installing.

Can I Sell Power Back to the Grid?

In North Dakota, it is possible to send electricity back to the grid under the net metering scheme, but it is not possible to sell and actually get paid for doing so.

The system works on a credit basis whereby the excess electricity produced by your PV system during sunnier times, is fed into the grid where it is stored for when your system has underperformed for that particular day and your home needs more energy than was generated.

With net metering, a battery bank is done away with and a contract is signed with the utility company to feed excess energy back into the grid. A smart meter is installed on the premises to automatically calculate the ebb and flow and electricity consumed in the household.

When the home’s power demand exceeds the system’s production, such as at night or at other times, the electricity meter will run backward to offer a credit against what electricity is spent. The amount of energy used “net” by a customer is the only amount charged on the utility bill.

When comparing net metering solar incentives by state, North Dakota hovers around the bottom because the state only offers what is known as an avoided cost rate.

What this essentially means is that the utility company will credit you at a lower rate for the surplus energy production your PV system feeds back into the grid, rather than the same tariff that they are charging you for normal usage. This puts you at a disadvantage.

This is not to say that net metering cannot be beneficial for you, but it does mean that your system ideally needs to be producing a lot more electricity. When the stored electricity is recalled by your smart meter, it will not have the same value as what was initially sent to the grid and more of it will need to be used to keep up with your energy needs.

Although one of the worst net metering programs in the United States, it can still be useful. And possibly more so when combined with a Power Purchase Agreement (PPA).6

What Is a PPA?

Utility customers who install solar systems have two options for dealing with surplus production – expensive battery banks or an unequal net energy metering (NEM) scheme. Bypassing the use of batteries will save a lot of money, yet to realistically use NEM effectively more panels would need to be installed to make up for the low buy-back credit tariff from the utility company.

A PPA is a method of saving on upfront costs and possibly producing more energy which will make using an NEM system more attractive. A contract between you and a third party might last up to 20 years if you and your solar provider opt into such an arrangement.

Through your agreement with the firm, you buy the clean energy produced by your solar array without having to worry about the costs of installation, the maintenance of any solar panel problems in the future, permits, or paperwork. Net metering combined with a PPA will more easily enable you to go solar if financial restrictions are making them too unaffordable even after the ITC.

A knowledgeable contractor will recognize the drawbacks of net metering in North Dakota and will compensate for the low buy-back tariffs by increasing the number of solar panels.

Of course, they will do their calculations to verify when they will start to make a profit and how long the payback period will be. For you, solar panels installed under this format are the most cost-effective alternative for long-term power savings.

Not only that, you may be able to have a PV system installed with perhaps only a manageable deposit if none at all. Afterwards, you can have the choice of either buying the system at a discount or renewing your contract at the conclusion of the term.

For homes that cannot afford the high up-front cost of a PV system, a PPA might be a viable alternative to securing an expensive loan, and many low-income households have been helped to switch to solar power through this system, allowing them to save thousands of dollars.

How much depends on factors such as your daily energy use, the size of your solar array, and how the electricity rates charged by your local utility supplier work.7

Contractor Requirements for Home Solar System Installation

Buying a house is going to be one of if not the biggest investment in your life. Any home improvement project has the potential to add to the valuation of the property, and solar panels are no exception if chosen correctly.

It is imperative, therefore, since you’re going to be investing a large sum of money into a PV system, that you get the right company to install it. Select the wrong contractor, and unavoidable solar panel problems will pop up to haunt you in the not-too-distant future.

When evaluating a potential contractor, there are several things you should look out for and inquire about.

- For starters, installers for a solar energy firm must have all the necessary credentials and expertise.

One of the most valuable credentials out there comes from the North American Board of Certified Energy Practitioners. If the firm has installers, they should have it. - Ask the business how many years they have been trading and check online if they have a solid reputation for high-quality work and after-sales service.

- Get quotes from several companies and don’t be shy about asking each of them if you can see some of their past work. Ask for references and take the time to visit local customers of theirs.

- Read the fine print of the warranty. Solar panels are generally problem-free, but you will want peace of mind that if anything goes wrong in the next 20 years the company will not only be around to fix it but will actually resolve the problem.

- Verify that they have all local compliance certificates in place and full insurance coverage.

- Do they provide loans, leases, or Power Purchase Agreement contracts?

- Ask them about all the North Dakota solar incentives, rebates, and tax credit programs that will apply to you. Even after all your research, there may be some you have missed or have just been initiated.

It cannot be stressed enough that a good contractor will provide you with the most efficient system for your home, even if it does cost a bit more than another quote. In the long run, though, that extra cost could be recouped within a faster payback period due to the quality of the PV system.

Solar panels may reduce your carbon footprint and save you money if you have high power bills, but even so, North Dakota is languishing in last place in the entire country.8

Despite the current situation, residents continue to invest in solar, optimistic that North Dakota solar incentives will eventually make the state a powerhouse in the solar industry, but regardless, the energy costs savings make the move profitable.

Frequently Ask Questions About North Dakota Solar Incentives

Can I Get Solar Panels Free in North Dakota?

Solar panels are not free in North Dakota. A PPA or a lease agreement may install them free of charge, but the cost will be recouped through the tariffs set under the terms of the contract.

What Do Solar Panels Do?

The sun’s rays are converted into electricity via the use of solar panels and then they are broken into two distinct categories: electricity and heat. From there it’s a matter of the inverter changing the energy from direct current to alternating current so it can then be harnessed for household usage purposes.

What Happens if I Stop Paying My Solar Lease?

The leasing market in North Dakota is very beneficial to residents but if for whatever reason the homeowner is not able to continue with the payments, the solar company has the right to repossess their property.

References

1Ciolkosz, D. (2023, March 9). What is Renewable Energy? Penn State Extension. Retrieved September 4, 2023, from <https://extension.psu.edu/what-is-renewable-energy>

2U.S. Internal Revenue Service. (2022, December 6). Residential Energy Efficient Property Credit [PDF File]. IRS. Retrieved September 4, 2023, from <https://web.pdx.edu/~wamserc/solar/summer09/Federal%20Tax%20credit.pdf>

3Frazier, R. S. (2017, March). Solar Electric Systems for Homeowners. Oklahoma State University Extension. Retrieved September 4, 2023, from <https://extension.okstate.edu/fact-sheets/solar-electric-systems-for-homeowners.html>

4University of California, Davis. (2021, November 5). What is Solar Power? UC Davis. Retrieved September 4, 2023, from <https://www.ucdavis.edu/climate/definitions/how-is-solar-power-generated>

5U.S. Environmental Protection Agency. (2023, February 5). What Is Green Power? EPA. Retrieved September 4, 2023, from <https://www.epa.gov/green-power-markets/what-green-power>

6U.S. Environmental Protection Agency. (2023, February 5). Solar Power Purchase Agreements. EPA. Retrieved September 4, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

7Terhune, L. (2016, November 18). What is the power grid and how does it work? ShareAmerica. Retrieved September 4, 2023, from <https://share.america.gov/what-is-power-grid-and-how-does-it-work/>

8Cho, R. (2018, December 27). The 35 Easiest Ways to Reduce Your Carbon Footprint. State of the Planet. Retrieved September 4, 2023, from <https://news.climate.columbia.edu/2018/12/27/35-ways-reduce-carbon-footprint/>

9Photo by Raze Solar. Unsplash. Retrieved from <https://unsplash.com/photos/nAgFqMO0t4A>